The probate system for distributing property after death traces its roots back to British common law. the decedent’s purported will, if any, is entered in court, after hearing evidence from the representative of the estate, the court decides if the will is valid, a personal representative is appointed by the court as a fiduciary to […]

Happy Memorial Day! Honor our fallen heroes and vets who defend our nation.

Income-tax planning really is a year-round pursuit. Now that April 15 has come and gone, here are suggestions for managing the rest of the year. Source: Taxes: Here’s how to pay less, get more back, on next year’s taxes | USA Today

Most Americans focus on tax planning during tax season. But tax season is about preparing returns, not doing the actual planning. There are steps that financially savvy individuals make sure they take with their tax professional. Source: What Financial Savvy Individuals Do After The April 15th Tax Deadline | Forbes

Did you get a refund this year? It would probably be better financial planning if you didn’t. Source: Why Tax Refunds Aren’t Really A Good Thing: How To Plan Better | Forbes

You work out to be health, here are three moves for financial fitness in your thirties. How to get a handle on your debt, start building wealth and stay on track for financial independence. Fiscal Fitness is sexy, so get your finances in shape. Source: 3 Steps To Financial Fitness In Your Thirties

Tax efficiency is a top concern for people with retirement savings, since it’s a guaranteed way to improve your wealth. Most retirement savings are qualified which means they are subject to RMDs (Required Minimum Distributions) and income taxes. We’ll cover some big levers around managing taxes. Source: Tax-Efficient Retirement Withdrawal Strategies

Try to take advantage of remaining tax-saving opportunities, get started early, and choose the right person to prepare your taxes. Then, maybe tax season won’t seem quite as taxing. Source: 3 Common Mistakes You Don’t Want To Make This Tax Season

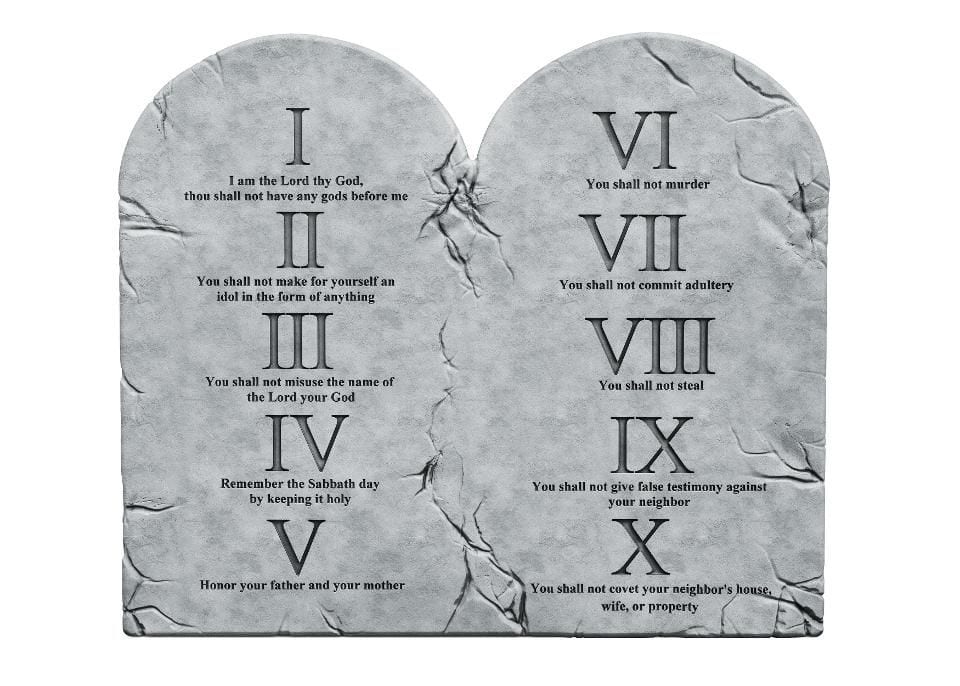

Taxation and religion are not very similar, at least not for most of us. But certain tax rules seem nearly absolute enough that they might seem akin religious principles. These rules seem clear enough that ignoring them may even bring lightning-bolt-out-of-the-sky consequences. These 10 rules are not commandments in the biblical sense. Still, they are […]

A corporate tax is a levy placed on the profit of a firm to raise taxes. After operating earnings are calculated by deducting expenses, including the cost of goods sold (COGS) and depreciation from revenues, enacted tax rates are applied to generate a legal obligation the business owes the government. Rules surrounding corporate taxation vary […]